Why The Yield Curve Inverting Further Could Be Dangerous For Stocks & Bonds

U.S. Treasury 2-Year/10-Year Yield Curve Hits Record Inversion Since 1981

The 2 Year Yield is rising to decade highs while the long-term yields are steady.

This will soon become a very dangerous environment for stocks, however, this does not necessarily mean we will see great performance in bond returns either.

The yield curve has inverted further after Jerome's chat with congress.

Why?

Fed Chair J Powell said these three things…

1) “Data suggests we’ll have a higher terminal rate in our next seps”

2) “Nothing about data suggest we have tightened too much, rather suggest we have more work to do”

3) “Ultimate rate peak likely to be higher than expected”

The deepening yield curve inversion has driven an increase in bond buy calls due to fears of a recession incoming.

Recessions tend to not be great for stocks but here is why it could also possibly not provide great bond returns…

To make money in markets you need to have a correct non-consensus perspective. YC inversion preceding a recession is NOT a non-consensus view. Everyone knows that YC inversion is a good track record for predicting recession, therefore, it’s not insightful market narrative.Yes, YC inversions typically lead to a recession & recessions typically lead to good bond returns, however, YC inversions do not always lead to good bond returns.

Let’s look at returns of bonds during YC inversions

Late 70’s/Early 80’s : bad returns

Late 80’s : flat returns

Late 90’s : good returns

Late 00’s: good returns

What might be the reason for these bad bond returns in the late 70s/early 80s?

The reason is inflation; and with inflation comes rate hikes.

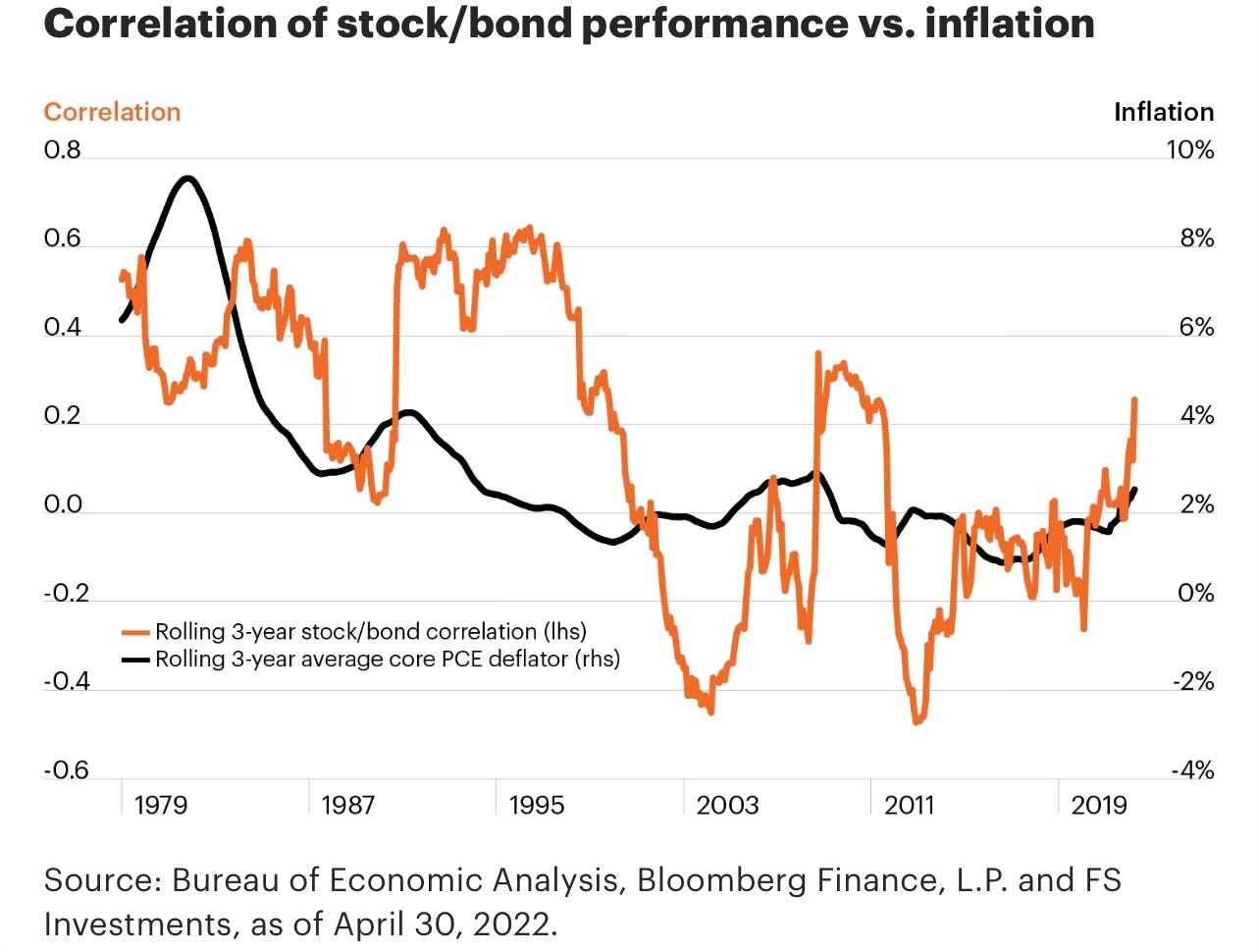

It is know when inflation is high the strength of correlation between stocks and bonds decreases leading to both not performing as well.

Powell recently stated “Breadth of revisions to previous quarters suggests inflation is running higher than expected” and “core inflation has not come down as fast as we hoped”. With inflation not on pace to reach its 2-3% target, we can expect rates to continue to rise.

High inflationary periods, followed by rate hikes which we saw in the late 70s/early 80s as well as well as 2022 are known to not provide great performance for stocks & bonds. If the Fed continues to raise rates at 50+BPS we could see another year disappointing year for not only stocks but also bonds.